Notes on Economic Geography of Regional Integration (Gill & Deichmann)

BONUS LINK: My entire (so far) grad school notes collection can be found here.

"To Regionally integrate or not to regionally integrate"

Overall Summary

The authors argue

that traditional assessment is debating the wrong issue. They are typically arguing which is

better—global trade agreements or more focused regional approaches.

2 False

assumptions:

- Debate also

assumes regional integration is just about preferential trade access

- It’s not an “either or”

choice—regional integration can act as a stepping stone allowing small states

to scale up their supply capacity—eventually giving them access to world

markets.

- Developing

countries must not only encourage transformation across its industries and

services but also spatially within its borders—this means balanced growth in

density, distance and division. This

spatial distribution can help alleviate the fates of the “bottom billion” that

are still accumulating to urban centers that don’t have access to the global

markets—exacerbating their situation in ever growing slums. This requires thoughtful and intentional

government planning at the 3 spatial levels:

Connective Infrastructure

Blind Institutions

Targeted Incentives

What countries benefit most?

They are quick to

point out that ALL countries can benefit from this type of

integration—however—small countries located far from world markets can

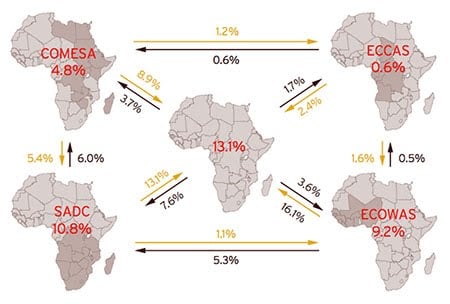

certainly benefit most. This usually means countries in Africa and

Central Asia.

Why?

Regional integration allows: boosted supply capacity by

providing regional public goods and maximizing specialization

3 key principles:

Start Small, Think Global, Compensate the least fortunate

Start Small—clearly defined narrow areas of

cooperation—EU started out as agreement by six countries on coal and stell

Think Global—No Islands! Access to global markets is the key! Small poor landlocked countries MUST have

regional integration to LEAPFROG them into the global scene

Compensate the Least Fortunate—development means

specialization and drives population to those centers. This must be balanced with remittances as

well as explicit compensation for infrastructure and social services (to

promote even spatial growth). Also

requires local effort and government policies like revenue sharing to

compensate the landlocked countries.

This requires a tailored approach (all to overcome thick

economic borders):

1. Regions close to major world markets

Common

institutions key (thin economic borders)

2. Regions with big economies far from world markets

Regional infrastructure to

increase home market which also increases access for small countries (connect)

3. Regions with small economies far from world markets

Bottom

billion countries. Need ALL THREE

I’s: Institutions, Infrastructure and

Incentives (increased support for infrastructure development for instance).

SUMMARY:

-->

SUMMARY:

The authors basic argument is that most economists have been

asking the wrong questions and making the wrong assumptions. This boils down to two common false

assumptions:

1. Regional integration is just about preferential trade

access

2. Regional

integration and global trade agreements are an “either” “or” proposition.

They argue that these assumptions ignore the relationship

between the two methods and that the approach needs to be tailored to each

nations geography (both physical and economic).

To that end they argue for three combined approaches:

1. Institutions blind

to the physical borders

2. Connective regional infrastructure to enable trade

3. Incentives for the

more isolated power countries.

Using these approaches can boost a small nation’s supply

capacity and allow for the maximization of specialization.

The authors

are quick to point out that while small geographically isolated underdeveloped

countries are the ones most likely to benefit from this approach (most African

and central Asian nations), ALL nations can benefit. The key for the small nations disconnected

from the global market is spatially purposeful development—meaning spatial

balance for density, distance and division.

The common propensity is for the population of developing countries to

migrate to the urban centers. But when

these urban centers are isolated without access to the global markets this just

creates slums. This is one of the

central problems described by Collier in Bottom

Billion. This phenomenon follows

Kuznet’s widely accepted hypothesis that describes how poor localized

agricultural economies experience a rapidly widening income gap when

urbanization occurs.

Regional integration then offers these nations a springboard

by which they can develop evenly and gain access to global markets

eventually.

The authors

advocate three central principles. The

first is to start small. They give the example of the European Union which

originally began as a trade agreement between three nations regarding coal and

mining. A narrow focus allows countries

to develop evenly and to focus on full economic integration. The next principle to think globally. The end result is never solely regional

integration but is instead using that connective infrastructure to leapfrog a

small cutoff country into the global economy.

The last principle is to compensate the poor or disadvantaged. This means that a government must be

purposeful in balancing urban development by raising the baseline of the physical

infrastructure in the nation.

Practically this means paving roads and ensuring an expansion of

baseline social services. This can also

take place in the form of remittances sent back home to the countryside which

when used well can spur development there.

Overall,

the authors stress the need to overcome the thick economic borders of many

states. They describe how large nations

with access to the global economy benefit from integrated institutions. They add that large nations far from the

global market can expand their reach through a connective regional infrastructure. Lastly they add that the small nations far

from the global market can benefit a combination of institutions,

infrastructure and incentives.

LINK:

http://www.imf.org/external/pubs/ft/fandd/2008/12/deichmann.htm

No comments:

Post a Comment